Sole Trader Tips!

We know running and keeping records for a business for the first time can be overwhelming so here is a handy guide on which expenses you can claim on your self assessment tax return.

Personal Expenses

If you use something for both business and personal reasons you can only claim allowable expenses for the business costs.

A great example of this is your mobile phone bill, say the bill for the whole year totals £200. Of this, you spend £130 on personal calls and £70 on business. You can claim for £70 of business expenses.

If you work from home you may be able to claim a proportion of your costs for things like:

- heating

- electricity

- Council Tax

- mortgage interest or rent

- internet and telephone use

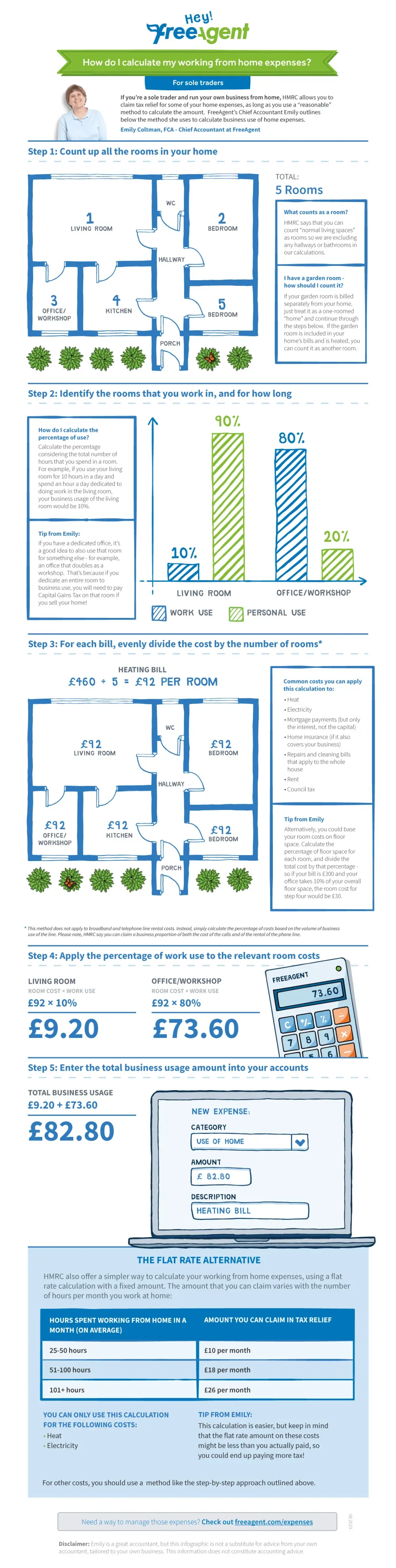

You’ll need to find a reasonable method of dividing your costs, for example by the number of rooms you use for business or the amount of time you spend working from home. Say you have 4 rooms in your home, one of which you use only as an office and your electricity bill for the year is £400. Assuming all the rooms in your home use equal amounts of electricity, you can claim £100 as allowable expenses (£400 divided by 4). If you worked only one day a week from home, you could claim £14.29 as allowable expenses (£100 divided by 7). The infographic to the right is a great way of explaining it!

Simplified Expenses

You can avoid using complex calculations to work out your business expenses by using simplified expenses. Simplified expenses are flat rates that can be used for: vehicles working from home living on your business premises.

Capital Purchases

If you use traditional accounting, claim capital allowances when you buy something you keep to use in your business, for example: equipment machinery business vehicles, for example cars, vans, lorries You cannot claim capital allowances if you use your £1,000 tax-free ‘trading allowance’.

Business Running Costs

Costs you can claim as allowable expenses These include:

- Office costs, such as stationery or phone bills

- Bookkeeping & Accountancy fees

- Travel costs, for example fuel, parking, train or bus fares

- Clothing expenses with company embroidery like uniforms or high viz clothing.

- Staff costs such as salaries or subcontractor costs (with a receipt)

- Things you buy to sell on, for example stock or raw materials also known as cost of goods.

- Financial costs, including insurance and bank charges.

- Costs of your business premises, for example rent, heating, lighting, and business rates

- Advertising or marketing, such as website costs paid advertising.

- Training courses related to your business but only refresher courses or courses to enhance a skill you cannot claim to learn a new skill.

We hope this has helped put your mind at ease and it has given you a handy overview of what expenses you can claim. This list is not exhaustive and what you need to ask yourself is "is this purchase wholly and exclusively for the use of the business" as this is the test that HMRC will apply.

If you would like to enquire about our monthly bookkeeping services please do not hesitate to get in touch we have packages starting from £90 per month. We also have a flat rate fixed fee for our one off self assessments so when the time comes please do not hesitate to get in touch with us for a hassle free tax return...

Good Luck with your new business and we wish you a prosperous first year!

Interested in our services? We’re here to help!

We want to know your needs exactly so that we can provide the perfect solution. Let us know what you want and we’ll do our best to help.